Payroll Net Pays

Self-service "Payroll Net Pays" empowers you to control where your pay is deposited – without asking someone to make the change for you. When this is available, access is provided on the Employee Information page.

With this option, you can have your pay go to up to 3 different accounts. For instance, part of your pay could go to a checking account, and you could spit the rest between two different savings accounts. You can also just have one account, two accounts, or have all of your pay as a printed paycheck.

How soon a change to a direct deposit effects your pay depends several factors, including:

- when in the pay cycle the changes were saved, and

- if you identified a different account or bank or changed the order, and

- whether the net pay item is set to confirm account information with the bank (a process called a pre-note) before paying to that account.

CAUTION: Net pay changes can take two or more pay periods. If your employer confirms account information with the bank, an account change can switch your payments to a paper check for one or more pay periods. When drawing funds, automatic payments, checks, etc., based on self-service net pay changes, confirm funds were deposited as expected first.

Organizations can activate the Payroll Net Pays option for employee self service, manager self service, or both.

When you are in employee self service, you can manage your own account information.

From manager self service, a manager can help employees enter and review account information.

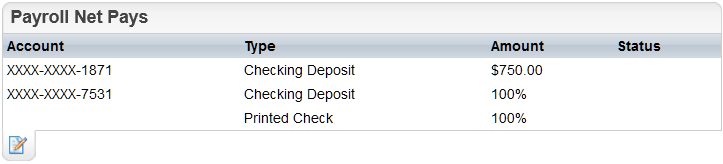

Summary of Payroll Net Pays

On the Employee Information screen, the last 4 digits of the account are listed.

Summary of Payroll Net Pays

To create or edit the net pay direct deposit information, click on the icon with a paper and pencil in the Payroll Net Pays section of Employee Information.

Effects of Changes

Begin date? The Begin date is based on the next scheduled, un-posted payroll for the pay group.

CAUTION to Employees: To see the results of a change, it can take two or more pay periods. Use caution when drawing funds, automatic payments, checks, etc., based on self-service net pay changes.

If your employer confirms account information with the bank, making an account change could switch your payments to a paper check for one or more pay periods.

The date on a new net pay will be the current date.

Paper Checks and Delay in Accounts being Changed. It can take one or two pay periods for these changes to take effect. Changing employee net pay can result in one or more pay periods being paid as a printed payment. During this time, payments may also be sent to the prior account(s).

Some organizations require all direct deposit changes to be verified through a pre-note process. If prior account numbers are changed through employee or manager self-service, this can mean that your usual direct deposit could temporarily become a printed check for one or two pay periods.

For the fastest change possible, you may need to consult with your Payroll department regarding how soon a net pay will take effect.

Maximum of 3 direct deposits. If an employee has more than three different accounts for payroll direct deposit, all accounts over three will be end dated when this process is used. For instance, if an employee has 5 direct deposit accounts, two will be deactivated based on sequence number. When these are deactivated, any defined dollar amount or percentage is replaced with zeroes and the process payroll checkboxes are de-activated.

Employee Direct Deposit Changes

- Sequence. A maximum of three direct deposit records can be defined.

- 1st Direct Deposit. The first direct deposit is the first account that receives a net pay. A Payment % of 100 shows that all of your pay is going to one account.

- 2nd Direct Deposit. The second direct deposit is the second account that receives a net pay. If the first account has a Payment % that is less than 100 and if any Flat $ Amount is less than the total net pay, there will be some net pay allocated to the second account.

- 3rd Direct Deposit. If the first and second accounts have a Payment % that is less than 100 and if the total of any Flat $ Amounts is less than the total net pay, there will be some net pay allocated to the third account.

- Physical Check Payment. In case there is any net pay left after any direct deposits, there is a physical check payment record. This has 100% as the percent of remaining net pay to be paid on a physical check.

Checking/Savings

There are two types of accounts that can be used for direct deposits of net pay.

- Checking Account.If an account is classified as a checking account by the bank, select Checking Account.

- Savings Account.If an account is classified as a savings account by the bank, select Savings Account.

Payment % or Flat $ Amount

For each direct deposit, enter a Payment % or a Flat $ Amount. The percentages are applied in order. So, if you wanted all of your pay to go to two accounts, the first direct deposit would need a Payment % of less than 100 or a Flat $ Amount that was less than your total net pay, and the second would need a Payment % of 100.

Routing Number and Bank Account Number

On this screen, type in the bank number and account number and the verifications again to confirm those. Copy and paste is not available in these important banking fields. Even if direct deposit is set up, you will still need to type in the bank number and account number verifications again to confirm those before saving any change on this screen.

The routing number identifies the bank or financial institution. The system will try to make sure the routing number that you enter matches a bank or financial institution. Make sure to enter the exact routing number needed for the account.

The account identifies your exact account number for an account at the bank or financial institution. The system will try to help you enter a number that is long enough to be valid at a bank. Your account number may need to be longer than the minimum.

Save

To keep the changes, click on Save and confirm that you want to change this information. Before the changes are saved, the system checks the following:

- Bank transit number verification and account number length. After clicking on Save, the screen validates the routing and bank account numbers. The numbers and re-keyed numbers need to match. The bank transit number needs to match an available bank transit number. The account number needs to be a minimum of 4 and a maximum of 17 digits. Most bank account numbers are longer.

- Prompt to Show Fund Allocation. The system also calculates fund allocation and tries to represent that. The allocation is based on the employee's payroll salary on the Compensation/Payroll tab.

If the transit number does not match available transit numbers, an alert displays. If the account number is less than 4 digits, an alert displays.

In some cases, the prompt may overstate compensation in order to show the potential results of an allocation. This can occur when the employee’s standard pay per pay period is less than whole dollar amounts entered for the net pay allocations.

After all data is entered again as needed, click on Save again.

- Prompt to Save. Review the "Are you sure" prompt. An example based on your defined pay amount displays. Depending on the number of allocations, the total may be overstated.

To complete the save, click on OK.

Validation Messages

[1st, 2nd, or 3rd] Direct Deposit routing numbers check digit verification indicates an invalid ABA number.

If this message displays, then the bank transit numbers entered for a direct deposit do not match bank transit numbers on file. Whether it is for the 1st, 2nd, or 3rd is identified by the first part of the prompt.

[1st, 2nd, or 3rd] routing numbers must match.

If this message displays, then the bank transit number and the re-keyed bank transit number do not match. Whether it is for the 1st, 2nd, or 3rd is identified by the first part of the prompt.

[1st, 2nd, or 3rd] Direct Deposit account numbers must match.

If this message displays, then the account number and the re-keyed account number do not match. Whether it is for the 1st, 2nd, or 3rd is identified by the first part of the prompt.